The Forex Week Ahead

The Forex Week Ahead

After much turbulence in world financial markets this past week, we look ahead to the first full week of Forex trading with the US Presidential elections in the rear-view mirror.

Commodity Pairs

AUD/USD

Friday saw further downward pressure on the Aussie after reaching a low of 0.7525 and eventually closed the session around the 0.7544 mark.

A further sell off in base metals, especially gold, continued late last week, adding much pressure to this commodity pair that started crumbling after the USD showed continuing strength as a result of the presidential outcome.

It is anticipated that a breach of the 0.7500 big figure will be tested, and a week ending closer to the 0.7400 mark is definitely in the cards.

Mondays monetary policy meeting and a few other releases may create some volatility but nothing too exciting is anticipated.

USD/CAD

The Loonie seems to be tracking the same path as the Aussie, but the Presidential election outcome with Trump at the helm and his opposition to NAFTA and TPP is creating a little angst to the USA neighbor. Fridays core CPI announcement may move the needle a little but the Cad, like the Aussie is expected to continue to extend its weakness against the Greenback.

EuroZone and UK

Other than Cable (GBP) which has shown some resilience late last week, surging to a high of 1.2673 the highest level we have seen for months. BOE sentiment to keep rates unchanged is also fueling speculation that the GBP across the board can expect the momentum to follow through into the new week. Tuesdays retail sales figures always get the Pound to react one way or another.

Once again we look toward the Greenback tracking a little higher against the common Euro zone currency and the safe-haven; Swissie.

Asian/European Crosses

USD/JPY

Ever since the elections, the Greenback has surged against the resilient JPY, moving over 500 pips since last Wednesday and this week a test of the 108 level and beyond can be expected.

There are no major impacting announcements scheduled for this week.

EurJpy / GbpJpy / ChfJpy

Our belief is these crosses will track exactly in line with what the USD/JPY pair is doing and we expect a continuation of Jpy weakness against its major European counterparts.

One word of caution – the markets have been very fickle of late. One minute they love Trump and the next they don’t. Our recommendation is to be aware of statements and moments when Trump gives us more insight into his thinking on U.S. policy changes.

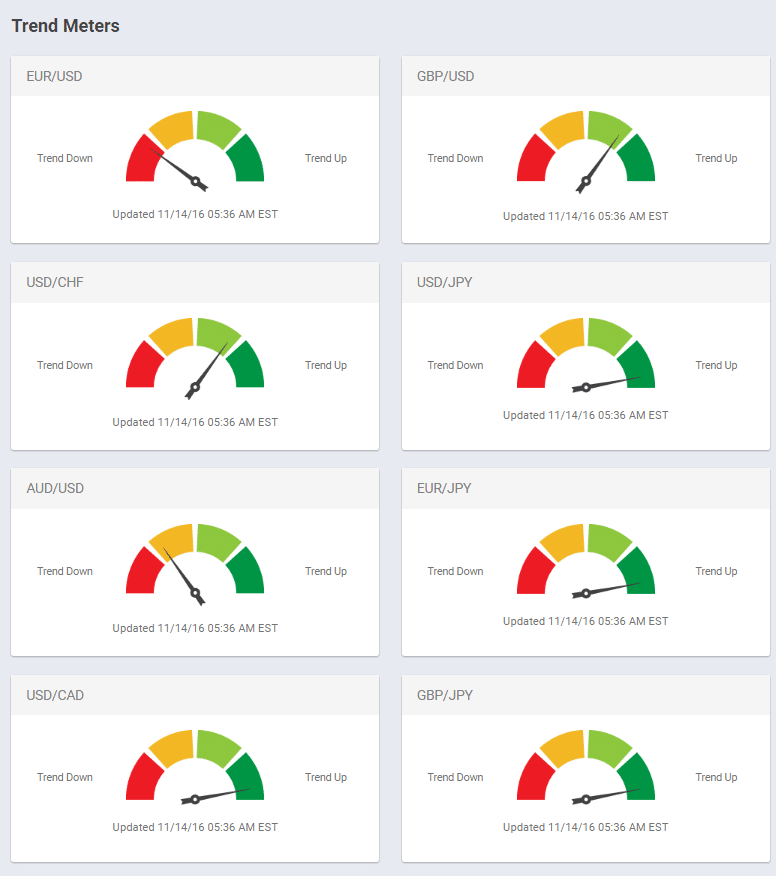

Trend Meters

Our Trend Meters for the Majors and Commodity Pairs for November 14, 2016. Trend Meters are updated daily by the ForexSignal Trading Team and access to our Trend Meters is included with all ForexSignal subscriptions.

The Forex Week Ahead

The Forex Week Ahead

Leave a Reply

You must be logged in to post a comment.