The Best and Worst

The forex week has begun again and there is some exciting news about the best and worst performers coming out of the London and Asian sessions.

GBP

The British sterling turned out to be the worst performing currency at the London session this morning. This came about even though there were no apparent catalysts. Forex analysts have attributed the weakness of the sterling to the profit taking which occurred after last week’s huge move and partly due to the speech by BOE’s Governor Mark Carney where he confirmed it unlikely for any upcoming hikes in the interest rate.

During the session, the GPBUSD pair dropped to a low of 1.3464 after hitting a high of 1.3616. The GBPJPY dropped to 150.13 after hitting a high of 151.53

CHF

The Swiss franc was the best performing currency Friday-Monday even though it didn’t do so well last week. There is no clear reason as to why the CHF ended up as the strongest today but one of the likely reasons could be the fact that while some traders were betting on the GBP ahead of Carney’s speech; there might be other traders who wanted to be safe and thus went for the CHF.

The USDCHF dropped to 0.9564 and then the swissy reversed some of it gains as it sits at 0.9628 as of midday in the USA session.

Comdolls

The comdolls were all weak during the London session, attributed to the commodities rout earlier today. The AUD happened to be the weakest of them all after it closed the session weaker than its counterpart the NZD.

JPY

The JPY was really hit after the possibility emerged that Shinzo Abe might stay in power just a bit longer and may fully implement his Yen-bearish policies. The USDJPY began the week with a 35 pip price gap at the opening, and the yen has continued to weaken steadily throughout the session, especially against the greenback and euro.

Forex Weekly Events: Sep. 18-22 2017

The other events that are fixed for this week include:

- US housing data: Tuesday, 12:30. The report is expected to fall from the 1.23 million building permits that were recorded in July to about 1.22 Million for August. The Housing starts are expected to rise though from 1.16 million to about 1.18 million.

- US Existing Home Sales: Wednesday, 14:00. This is a crucial data as it comes just before the Feds make their decision. The sales of second-hand homes stood at 5.44 million in July, which was rather a disappointment. The data expected on Wednesday should be in the region of 5.46 million now.

- Fed decision: Wednesday, 18:00, press conference at 18:30. The Fed decision comes up after the US existing home sales. Market analysts are expecting the Fed to announce the start of Quantitative Tightening or the beginning of reducing its 4.5 trillion dollar balance sheet. The focus at this event will mostly be on the timing of the next interest hike. Alongside that, the Fed is also set to release the updated forecasts for this three areas; growth, employment, and inflation. The biggest interest will be on the rate updates with reporters likely going to press her about it during her press conference.

- Japanese rate decision: Thursday, early morning, the exact time is unavailable. With the Japanese Yen suffering during this morning’s Asian session, the next big data to be released by the Asian powerhouse will be their rate decision. They have struggled to achieve their targeted 2% inflation goal. It is noted that the BOJ is happy with the current weakness of the Yen.

- US jobless claims: Thursday, 12:30. Due to the hurricanes that have hit the country, it is expected that the jobless claim will increase to 300k from 284k

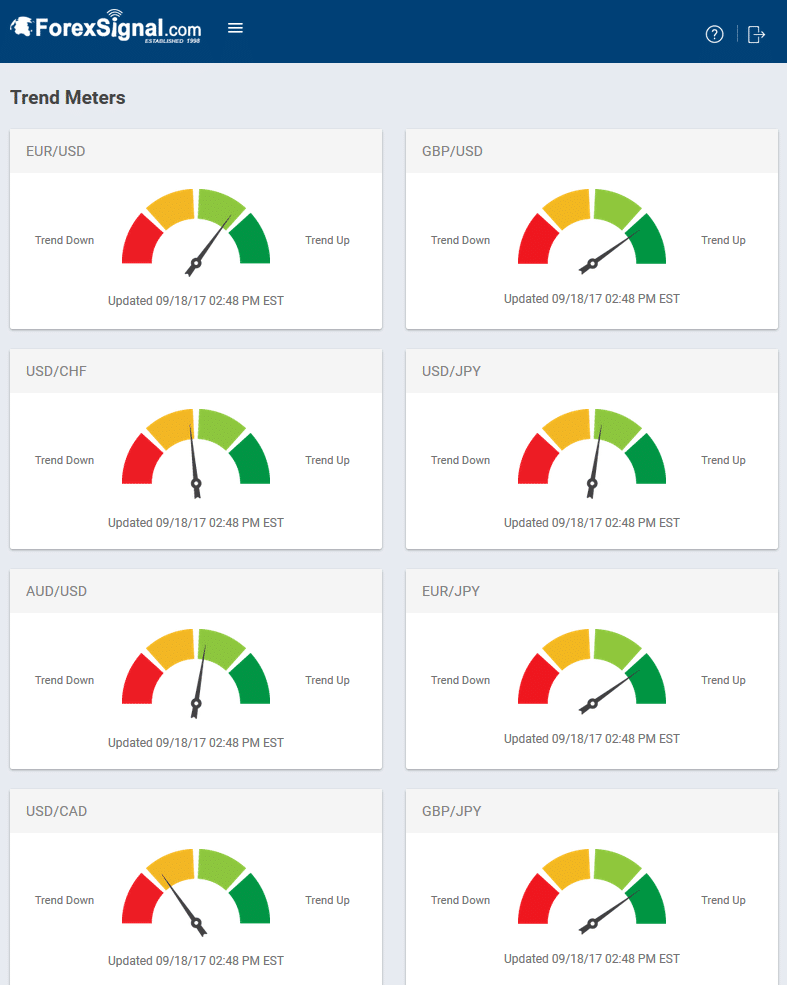

Trend Meters

This week we will show our Trend Meters on Monday and again on Thursday, and we will see how the overall trend has changed by the end of the week. Immediately by glancing at today’s Trend Meters, we can see that the USD weakness is not as acute as it has been in past weeks. Perhaps the USD is fighting to make a comeback? Time will tell.

Forex Signal Trend Meters are updated daily and are available for our subscribers by logging in to their online web dashboard. Are you a subscriber? Login now.

Not yet a subscriber? Sign up now.

Leave a Reply

You must be logged in to post a comment.