“Brexit Fears” Affecting The Cable (GBP)

“Brexit Fears” Affecting The Cable (GBP)

After the long Memorial Day weekend in the US and some banking holidays around the world a lackluster start to the week with a show of strength earlier in Tuesday’s session was reversed was quickly reversed across the board as “Brexit fears” started to look very real once again. It started with a 250 pip slump in the Gbp/Usd and the affects permeated across the board with the FXCM US Dollar index* spiking dramatically to reach its 52 week high, a hair short of 12,000.

The rest of the week should provide us with much activity now that the Brexit story is back in focus. In the event of a Brexit, economic uncertainties would increase and it is anticipated the UK would more than likely fall into recession by the end of next month. This is in turn could force the BOE to ease its monetary stance.

Tuesdays’ huge short GBP move reflects that sentiment. Governor of the Bank of England and Chairman of the G20’s Financial Stability Board, Mr. Mark Carney, further confirms this by explicitly stating that the BoE’s first response would be to cut interest rates. A renewed round of QE cannot be ruled out in this scenario. This being the case we can expect to see the Cable trading in the lower 1.30’s to Greenback Usd and lower 150’s to the Yen,

Mid-Week Releases and Fridays Job’s Report

Activity can be expected affecting the 2 major commodity pairs (USD/CAD and AUD/USD) with a spate of economic data announcements. Thursday should also see some strong activity across the board after the all-day OPEC meeting. The week’s grand finale climaxes with Fridays US Jobs report which just may offer traders some insight into the possibility of the Fed actually proceeding with an interest rate hike threatened for July. Time will tell!

As always the ForexSignal trading team is focused and looking to identify possible profitable trading opportunities as they unfold and alerting our clients worldwide with exact Entry Point, Stop and Take Profit levels.

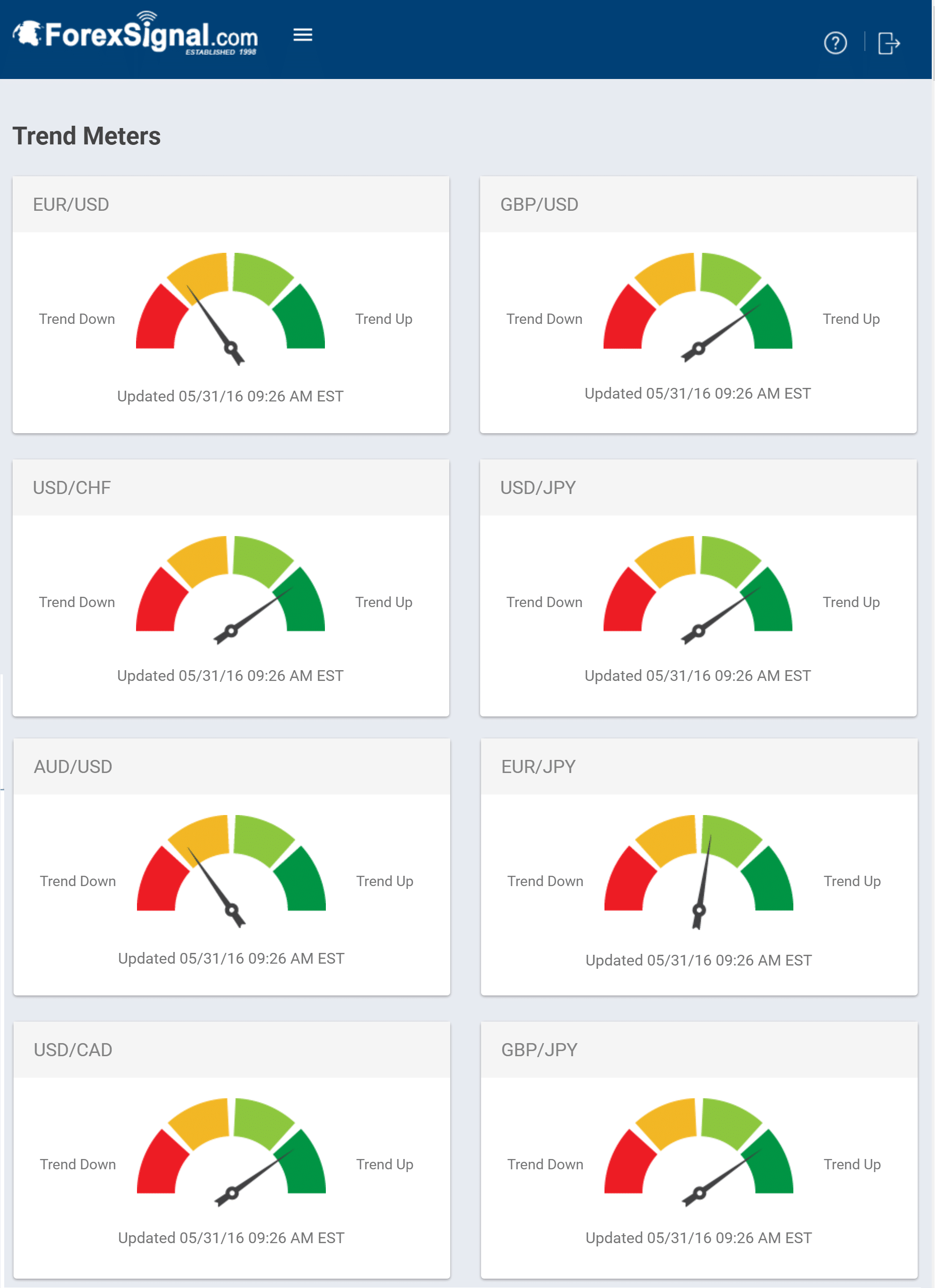

Trend Meters

Forex Trend Meters are updated daily and are accessible to all ForexSignal subscribers. View a snapshot of our Trend Meters at the threshold of June. ForexSignal.com subscribers can login to our members-only platform to view current Trend Meters at any time.

*The Dow Jones FXCM Dollar Index (USDOLLAR) is an index (or measure) of the value of the United States dollar relative to a basket of four currencies: the Euro, the British Pound, the Japanese Yen, and the Australian Dollar. On its inception, January 1, 2011, USDOLLAR began with a value of 10,000.

“Brexit Fears” Affecting The Cable (GBP)

“Brexit Fears” Affecting The Cable (GBP)

Leave a Reply

You must be logged in to post a comment.