EURUSD – 10 Day Decline

EURUSD – 10 Day Decline

The big question as the market reopened on Sunday night is – “can this continue?” Surely by now the Euro must be oversold. Every technical indicator is telling us that it is. As all technical traders know, the market never moves in a straight line, and today the Euro put up a fight to close higher after the 10-day losing streak as political developments led some support to the Euro as next year’s German and French elections are now on the radar. German Chancellor Angela Merkel announced on Sunday that she would not seek a 4th term, and this is regarded as positive for the Euro.

Japanese Yen

Against the Japanese currency, the dollar hit a 6-month high of 111.18 on Monday. The weaker Japanese currency is a side-effect of the stronger USD. The Japanese economy thrives of a weaker Yen, which provides stimulus for big Japanese exporters by lowering the price of Japanese goods.

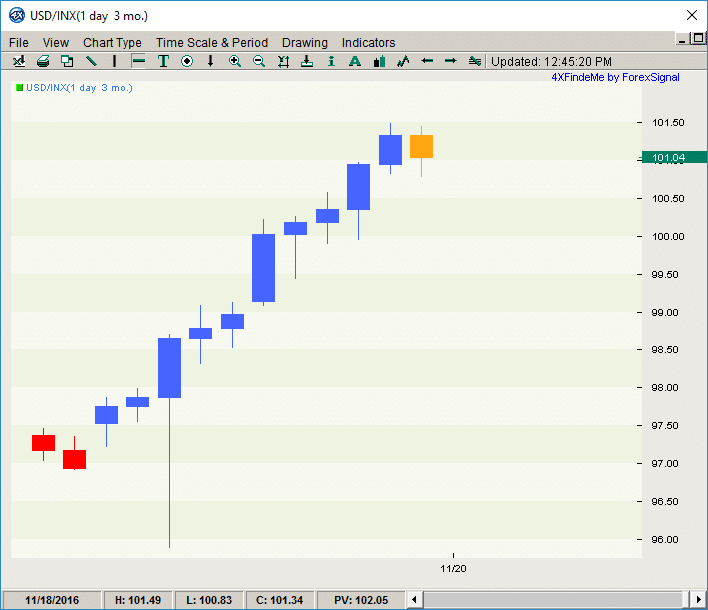

USD Index Sees Slightly Weaker Greenback

The stronger Euro today was boosted by the slight weakening of the Greenback against a basket of currencies, after the USD hit its highest levels in almost 14 years last Friday. The USD Index is a measure of the overall strength and sentiment of the value of the USD. It would make sense that after a 10-day rally, that the USD Index would eventually slow down, but that doesn’t change the fact that the Index is still very close to its 14 year high and it is not likely to see a full reversal of the rally just yet.

Dollar Still King

We wrote last week that the EURUSD parity is in sight by the end of the year, and now more than ever before we see the reality of this happening. We must assume a FOMC rate hike for the December 13-14 meeting has already been factored into the equation, and the markets are showing confidence in the “Trump Affect; the possibility of strong US growth, investor gain and business confidence.

Much of this is felt in the energy sector as the US reliant on overseas oil and gas will be tempered drastically. Positive local and CPI data rising in October by 0.5% from the previous year showed the fastest rate of growth in two years, while weekly unemployment claims fell to 235K, not seen at this level since November 1973.

Based on all the above elements the USD has nowhere else to go but up, unless something very out of the ordinary creeps into play.

Market Event To Watch

- Nov 22, 08:30 USA Retail Sales (MoM)

- Nov 22, 10:00 USA Existing Home Sales (MoM)

- Nov 23, 03:00 FRANCE Markit Manufacturing PMI

- Nov 23, 03:30 GERMANY Markit Manufacturing PMI

- Nov 23, 08:30 USA Initial Jobless Claims

- Nov 23, 08:30 USA Durable Goods Orders ex Transportation

- Nov 23, 08:30 USA Durable Goods Orders

- Nov 23, 10:00 USA New Home Sales (MoM)

- Nov 23, 10:00 USA Michigan Consumer Sentiment Index

- Nov 23, 10:30 USA EIA Crude Oil Stocks change

- Nov 23, 13:00 USA FOMC Minutes

- Nov 24, 2016 USA THANKSGIVING HOLIDAY, USA MARKETS CLOSED

We expect to see many Forex signal opportunities on Tuesday and Wednesday, and of course no trades while markets are closed on Thursday.

Leave a Reply

You must be logged in to post a comment.