The “Great Unwinding”

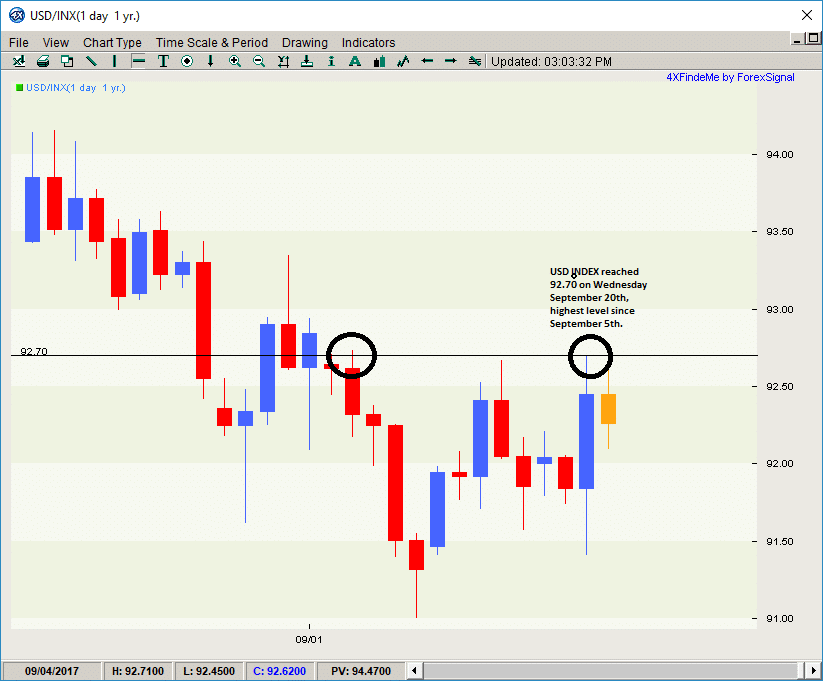

The signs that the US Federal Reserve will hike interest rates for the second time this year and the process termed as the ‘Great Unwinding’ of the past decade sent the bonds lower and spiked the USD Index to its highest level since September 5th.

The chances of a rate hike by the Fed in December is up to 70%, which is a significant rise from the 50% it stood prior to the Fed meeting.

Bank of Japan

As expected, the Bank of Japan kept its monetary policy unchanged, which also favored the USD. That combined with yesterdays Fed announcement has driven the price action of the greenback to a two-month high versus the Japanese yen.

Draghi Speech

The president of the ECB Mario Draghi made a speech today at the second annual conference of the ESRB and here are the highlights from the speech.

- Draghi mentioned that financial imbalances cannot be corrected using monetary policy. The only way these imbalances can be addressed is via macroprudential policies and these policies should be targeted at specific markets or countries.

- To fully assess the systemic risk of the European economy, the state of the banking system in the region is crucial.

- He finally called the authorities to be vigilante by using tools available to identify blind spots and stop risks from compiling unnoticed.

Overall, the EURUSD is trading higher today (Thursday) with a high of 1.1953 although it still has not made a full recovery from Wednesday’s sell-off.

Check out our EURUSD signal from earlier this week:

Leave a Reply

You must be logged in to post a comment.