What do we look forward in Forex trading in 2022?

Forex is globally the most traded market. Bank of England shared a semi-annual FX turnover survey report, according to which in April 2021, the daily average reported foreign exchange turnover hit $2.98bn. The COVID-19 pandemic drastically affected the global economy in the last couple of years, and now we are dealing with the effects of the Omicron variant. But Forex market analysts are hopeful about this year.

Forex Trading in 2022 – What to Expect?

Inflation and COVID-19 are the driving factors behind monetary policy decisions. The Forex market has always been focused on inflation to get an idea about strategies of the central bank regarding interest rates. If we see an increase in interest rates, it will boost a currency and vice versa.

COVID-19 has dramatically affected the economy so that consumer prices surged to their highest levels in 30 years. In November 2021, the Federal Reserve (Fed) chair Jerome Powell told Senate Banking Committee that the word transitory should not describe inflation. However, he also talked about expectations of an increase in interest rates. His comments boosted the US dollar.

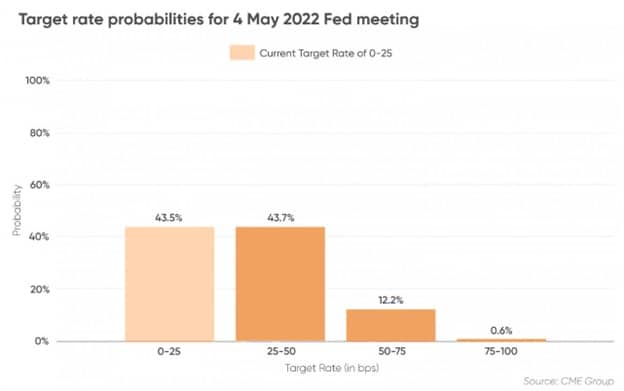

In 2022, the Fed suggests that the US dollar will rise in Q2 2022, which is soon to come. CME FedWatch tool says the market will go through an increase in interest rates in May 2022.

What do Experts say about Forex Trading in 2022?

By 2022, major investment banks are intensely hopeful about US dollar performance in 2022. So let’s see what analysts are thinking about Forex trading in 2022.

Analyst at ING says,

“All indicators point to strong US growth in 2022, nearly 5%, persistent inflation, and a Fed ready for policy rate lift-off. We expect further dollar strength against the euro and the yen through 2022, where the ECB and BoJ have a much stronger case to keep policy loose. We see the Fed cycle as being prone to being re-priced higher and gentle dollar strength as a constant theme for 2022.”

“Unless backed by commodity exports, we expect that European currencies, in general, to underperform against the dollar in 2022….”

Analysts at CIBC also predict the US dollar price increase in 2022. They say,

“Markets have overpriced BoC action in 2022 and underestimated the Fed post-2022. A recalibration will leave the CAD out of favor with investors.”

Most analysts are hopeful about a higher US dollar trend in 2022; some see its trend weakening in 2022. Analyst at FXStreet says,

“In 2022, the Federal Reserve may find itself returning to dovish self, weighing on the dollar. The easing of the supply chain could push global inflation lower, improving the mood. COVID-19 will likely pop up during the year but extend its retreat. Rising geopolitical tension could counter dollar selling. America’s mid-term elections mean Democrats will scramble to legislate.”

Closing Thoughts

It is impossible to predict what will happen in the Forex trading in 2022. Therefore, analysts predict according to their knowledge and experience in forex trading. Moreover, analysts use several tools to understand how a currency pair will perform as per particular data in the market.

But overall, according to analysts and tools, the USD dollar will perform very well in 2022. Of course, some factors can negate their forecast if the Omicron variant spreads, affecting the global economy. However, the predictions about Omicron also say that this year is going to be better than the previous two years. So, we can expect 2022 to be the year for the USD.