Why Did The Greenback Drop Today?

The Greenback dropped across the board against the USD majors as the market spooks ahead of the much-anticipated Fed meeting upcoming on Wednesday. Although since September, and especially since the U.S. elections, analysts and the central bank itself have assured us of almost certainty of an interest rate-hike. Such high confidence in the move means that if the expectations are correct on Wednesday, the market-moving potential of the hike may not be as dramatic as a surprise rate hike.

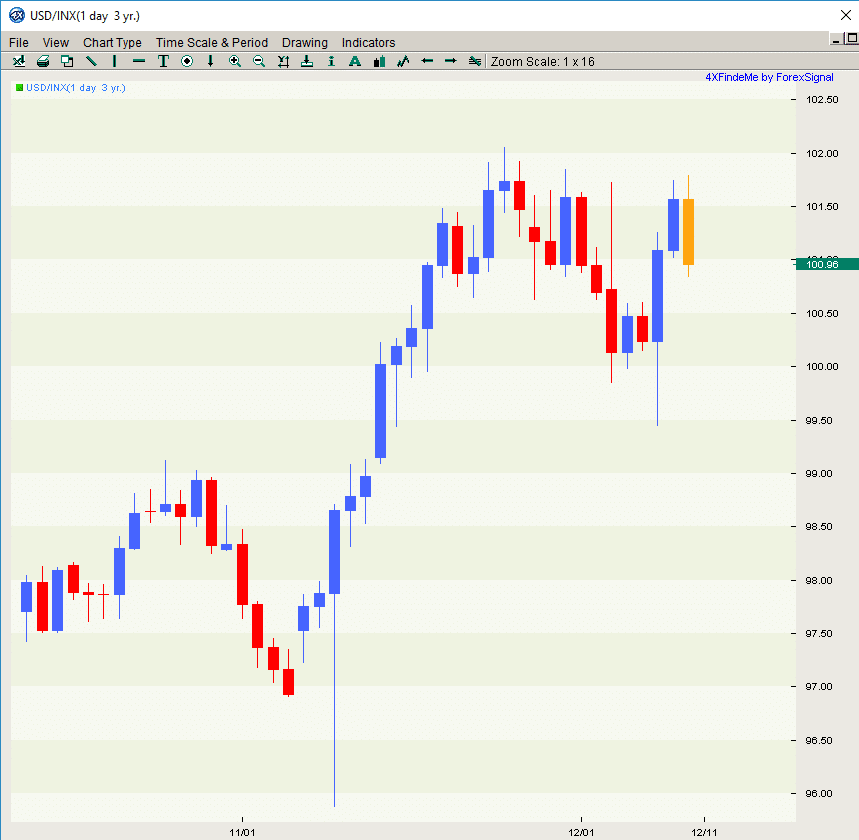

Even in light of such high confidence in a hawkish Fed policy, the markets showed today that there is still some anxiety connected with the outcome of Wednesdays’ much anticipated meeting. The US Dollar Index dropped today from a high of 101.79 to a daily low of 100.84. This 94 pip drop is not too concerning in light of the fact that the US Dollar Index has jumped 392 pips since November 4th and it is not likely to see a complete turnaround in the strong Dollar sentiment that has been building up since the elections.

If the Fed rips the rug from beneath our feet in the event of a shocker decision to keep interest rates the same, we will watch the markets fall all over itself in surprise.

But now, this scenario seems highly unlikely.

Wait For It…Ms. Yellen’s Speech

What may move the market move than the initial rate decision is Fed Chair Yellen’s press conference, scheduled for immediately after the announcement. Her reputation for ambiguous remarks and vague insight into future rate hike decisions means that the market react to any hint she may give in either the dovish or hawkish direction for 2017. So we may still see market volatility even in the event of the Fed doing exactly what everyone expects.

One thing we’ve learned this year is that the market never does what we expect it to do. At ForexSignal.com, we will be watching closely and sending Forex signals to our client base worldwide as our trading criteria is confirmed.

Leave a Reply

You must be logged in to post a comment.