Greenback – Victorious Week

Greenback – Victorious Week

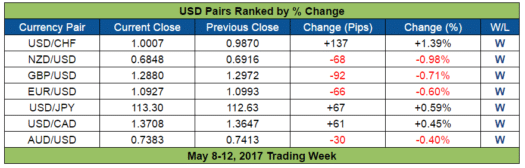

The U.S. dollar finally came out victorious last week on multiple fronts, ending up as the best currency in terms of performance for the week in perspective. It is more astonishing that the greenback accomplished this after mixed and messy prices of the past few weeks. Despite a political controversy, the dollar still gained last week as shown in the chart below.

May 8-12 Review

USD

Comparing the USD against other major currencies, it’s evident that even though the greenback hasn’t gain much strength, the recent USD rally comes from the weakness of its opposing currencies.

The greenback showed consistency in price action after rallying last week on Monday and Tuesday, instigated by the increase in the U.S. bond yields at the time and thus. this increase was due to the issuance of tens of billions worth of government bonds. President Trump’s dismissal of the FBI Director temporarily stalled the dollar’s rally

Following the two-day rally, the greenback still was trading strong but weakened due to the disappointing miss for U.S. April CPI and U.S. April retail sales. The CPI only rose by 0.2% month-on-month (with +0.3% expected) and retail sales increasing only by 0.4% month-on-month (+0.6% expected). By Friday’s session, the USD finally reversed some of its gains for the week but still mostly closed higher on Friday than at opening last Monday.

GBP, CHF

The GBP was the third worst-performing currency of the week. It started off very strong and it stomped its rivals, not including the Greenback, to the ground from Monday to Wednesday. Anyhow, demand for the pound was likely due to preemptive bets that the BoE would be a bit more hawkish. Additionally, poll results continued to give Theresa May’s Conservative Party a sweeping lead likely helped to keep the pound supported as well. Unfortunately for the GBP, the U.K. released some disappointing economic reports a few hours before the BoE statement which led to the weakening of the currency.

The Swiss franc had been at the top for the past few weeks, the CHF found itself at the bottom of the pile. The large demand of the Greenback in favor of the CHF drove the currency lower. USD/CHF, in turn, appears to be going in the same direction as the U.S. bond yields.

Forecast for May 15-19

According to the economic calendar, there is no election or political event happening in the next couple of weeks. This might be the main reason why over 50% of analysts with backing from at least half of the D1 oscillators predicts a lateral EURUSD movement.

Other experts believe that the two currencies will again test the high of 1.1000, while other experts believe that the pair will immediately head south. Interestingly, their point of view is supported by both graphical analysis and almost half of the H4 oscillators, which indicate that this pair is overbought.

As for the GBP/USD, the D1 trend indicators insist on the continuation of the sluggish-upward trend, which began in the last week of April. Over 30% of experts believe this point of view to hold out and that the pair will break the 1.3000 barrier.

An alternative point of view is presented by other analysts, 60% of trend indicators and 90% of oscillators on H4. They all insist that it will be best to start selling both currencies and the nearest suggested support is 1.2755. If we look at the medium-term forecast, the number of bear supporters among the analysts already exceeds 80%; 1.2100 is declared the main target.

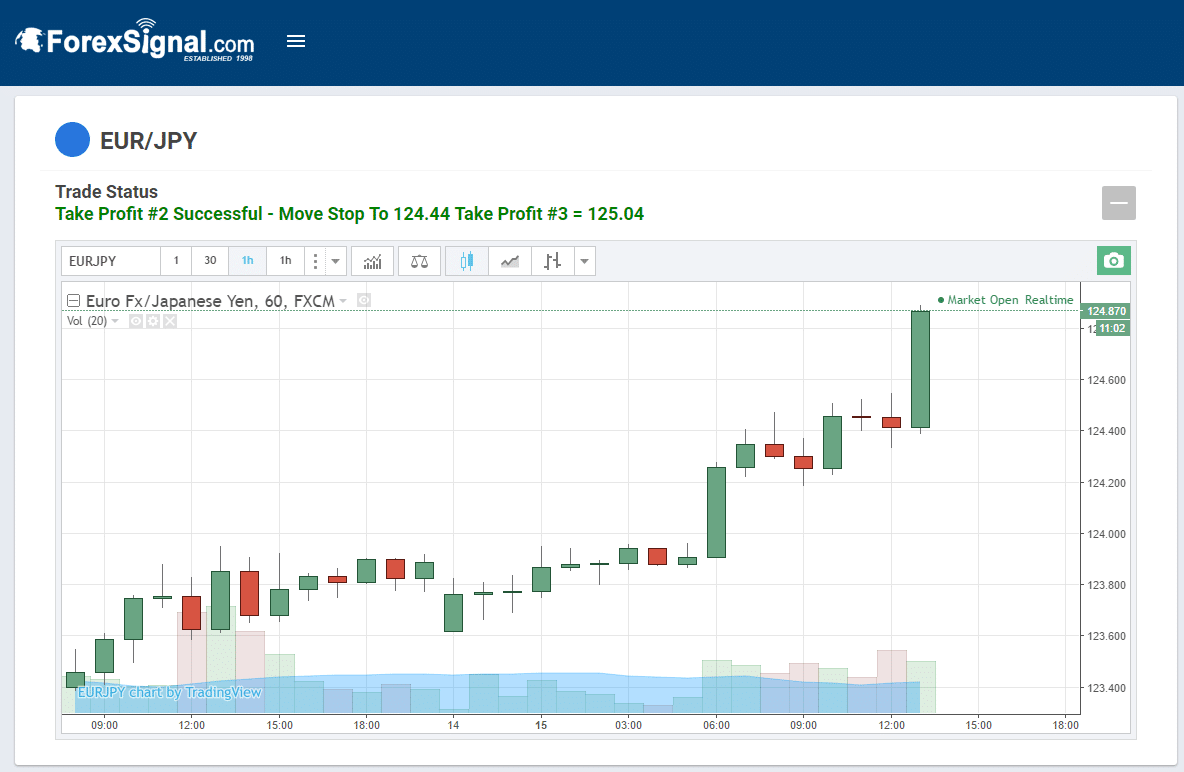

First Trade of the Week

This morning our ForexSignal Trading Team identified a buy opportunity on the EUR/JPY pair and as of the time we published this article, we have reached Target 2 success for this trade and closed the trade with over 40 pips profit on our Trade Copier.

Leave a Reply

You must be logged in to post a comment.