Greenback Edges Lower

Greenback Edges Lower

Today the Greenback skirted lower against the other major currencies as we edge toward the final days of a combative U.S. presidential campaign. Forex traders and investors also weigh in on the upcoming Federal Reserve Rate Decision and Monetary Policy announcement on Wednesday, and Friday’s Non-Farm employment report.

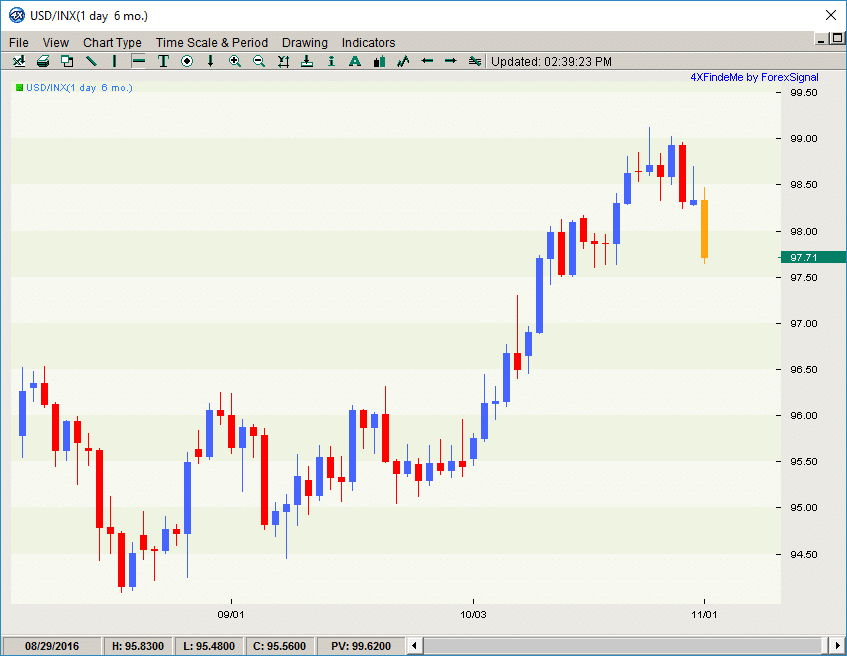

Dollar Index Weighs In

The U.S. dollar index, which measures the USD’s strength against a trade-weighted basket of currencies, dropped 0.75 points to a low of 97.72; its lowest point since October 20th. Overall for October, the U.S. Dollar Index gained 3% throughout the month, even after last Friday’s drop as the FBI announced that it would review more emails related to Ms. Clinton’s use of email during her time as secretary of state.

At this point in the campaign, any negative news about the Clinton campaign causes a drop in the Greenback which is apparent from recent trading.

FOMC, NFP

While the Fed release on Wednesday is also a big deal for the Greenback, it is considered extremely unlikely that we’ll see a rate hike this close to the election. December is still the big month and investors are looking ahead to possibly of a rate increase before the end of the year. And of course, as usual Friday’s job report will give clues about the health of the U.S. economy and if it may withstand an interest rate hike.

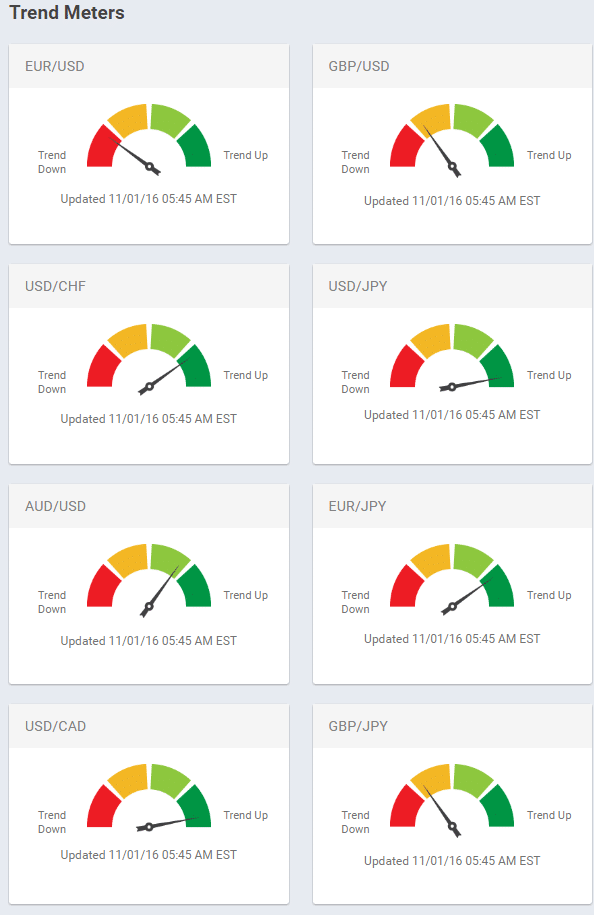

Trend Meters

The ForexSignal Trend Meters reflect the long-term daily trend and are updated at the start of each trading day. Access to the Trend Meters is available with a ForexSignal subscription. See below for the Trend Meters for November 1, 2016.

Greenback Edges Lower

Greenback Edges Lower

Leave a Reply

You must be logged in to post a comment.