NFP Outcome

NFP Outcome

Although the outcome was worse than expected, the Greenback initially strengthened as the Non-Farm Payrolls reported showed an increase of 161,000 jobs for October, suggesting an increased possibility for a Fed interest-rate hike in December. Wages also increased, which supports the view that inflation may speed towards the Fed’s target.

Despite the strong data, the market didn’t move too dramatically in light of the fact that the probability for a hike in December is already high, and in anticipation of next week’s election uncertainty.

Election Rumors

Winding down to the final days until the U.S. votes for a history-making Presidential Election, and the market has flip flopped with the polls as investors and traders shifted to a bias toward a Trump win, rescinding their long-standing opinion of a Clinton victory.

Historically and sensibly, economic data should drive the price of the Greenback up and down, but in an election race unlike any other the main driver has been disputes, words, rumors, and of course opinion polls. This sets us up for high volatility next week as the event and outcome unfolds.

With the Brexit outcome shocker, most Forex traders are heading into the new week with a sort of fear-factor, not wanting to be caught off guard in the anticipation of a possible Trump win.

USD INDEX

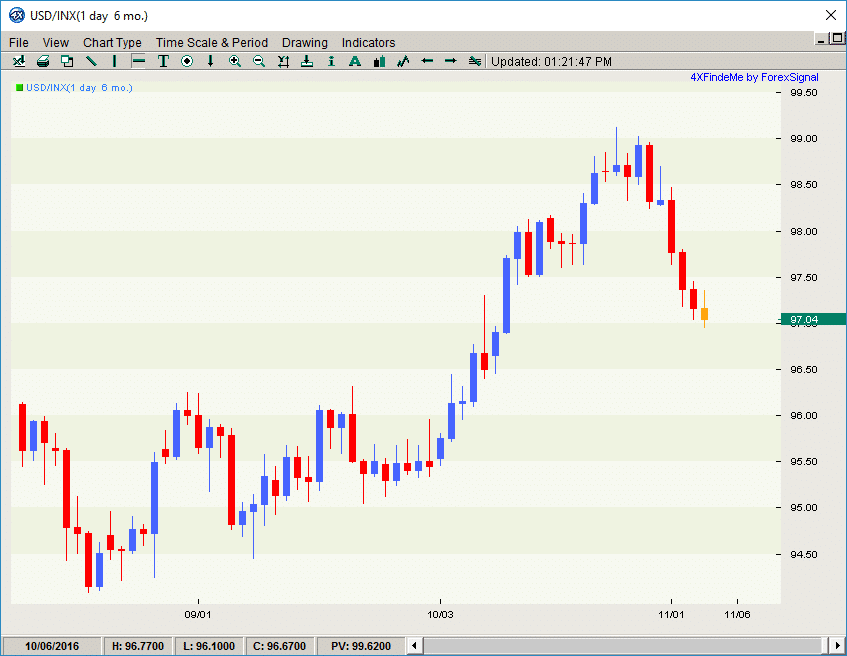

The dollar index pared losses for its 4th straight day, dropping to its lowest level since October 11th.

NFP Outcome

NFP Outcome

Leave a Reply

You must be logged in to post a comment.