Volatility Expected In The Week Ahead

Volatility Expected In The Week Ahead

With a long list of high impact announcements between December 1-December 4th, this week should be very interesting. Monday November 30th will likely be the calm before the storm with zero high impact events on the Economic Calendar. As always, on Friday the US NFP Jobs Report should provide us with some late week volatility.

Anticipated Direction for the Majors and Commodity Pairs

EURUSD

Outlook Direction: Short

The Euro continued its downward slide last week and we see a test of last weeks low imminent. Any attempt for the Euro to rally will likely encounter resistance at these 1.0750 and 1.0800, and we will expect a sell-off at those prices. Fairly strong support can be found at the small and large figure of 1.0500 and 1.0450 respectively, and represent good take profit objectives for traders holding short positions. We expect the Euro crosses pairs to be weak across the board.

USDCHF

Outlook Direction: Long

Last week the Swissy managed to achieve a new 5 year high and comfortably surpassed the notorious level achieved earlier this year when the SNB intervened and created so much havoc. There is no other reason for it to stop it’s surge and we see it as likely to continue.

GBPUSD

Outlook Direction: Short

The Cable made a new recent low and continuous short movement is anticipated for December and well into 2016. The ForexSignal trading team sees any rally as an opportunity to jump in at a good price for a short opportunity, and will inform our clients accordingly as this occurs. We anticipate a breakthrough early in the week below the psychological 1.5000 level.

USDJPY

Outlook Direction: Sideways

This pair continues to move sideways and we believe it’s neutral bias will continue to support further sideways movement. Logically, any breaks to the upside is much more likely due to the continuing strong outlook on the US dollar.

AUDUSD

Outlook Direction: Short/Sideways

It appeared the Aussie was looking to rally earlier last week but lower commodity prices and the increasing strength of the USD seems to have taken the shine off that possibility. We see a sideways week ahead and will look to execute short positions after a rally exhaustion only.

USDCAD

Outlook Direction: Long

The loonie was mostly sideways rallying at the end of last week. With the continuous weakening in the commodity and oil prices we expect to see a continuation of the long USD/CAD. Strong resistance is expected at the 1.3430-50 level.

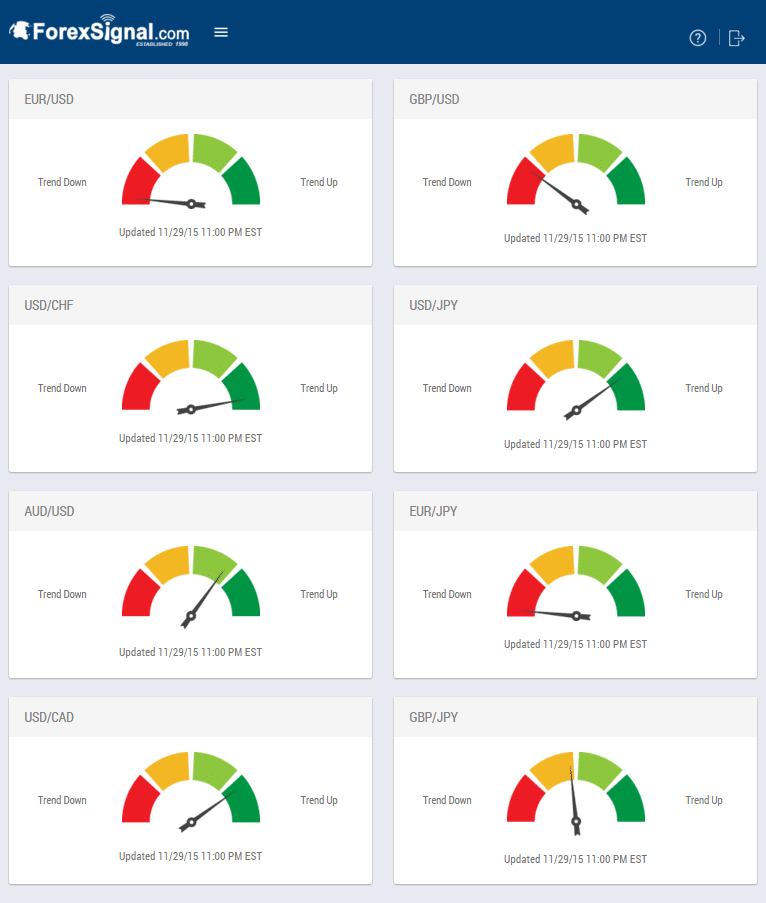

Trend Meters

Our Trend Meters are updated daily and available with all ForexSignal.com memberships. See below for the Trend Meters shown as a screenshot at the start of this week November 29-December 4, 2015. Members can login to our ForexSignal.com members only platform to view current Trend Meters at any time.

Volatility Expected In The Week Ahead

Volatility Expected In The Week Ahead

Leave a Reply

You must be logged in to post a comment.