USD – Trading With Caution

USD – Trading With Caution

President Trump’s executive order issued late last week added fuel to a 1 week old administration that started off with a sprint. While the authorities and travelers wrestle with exactly how it effects them, the markets reacted predictably; with caution.

USA stock market pressure was evident today and out the gate the large correction of the previous few weeks of bullish moves were quickly checked back into shape. Even though the sessions ended comfortably off its lows, the feeling of uncertainty and caution is very much evident. What’s next, as it appears many portfolios are being sidelined right now for the sake of caution.

I for one agree – a slow approach is a smart approach.

Yen Surges against the USD

As usual, safe-haven seekers turned to the Japanese Yen. The Swissie (CHF) also saw some action as risk averse traders hedged their situation while market participants try to digest Monday’s trading.

Heavy Data Week

Expect a very busy week on the economic data side. The first Fed meeting kicks off tomorrow with policy decisions announced on Wednesday. And don’t forget that this Friday bring NFP data for January. There is also a slew of data out of Japan, including BOJ decision this week. All this means that we could see some serious momentum in the Forex market in the days ahead.

This is much needed fuel to the fire, as we see the Forex market stuck in a fairly narrow range in view of market caution and political uncertainty.

View the support and resistance levels for trading January 30-31, 2017

EUR/USD

Resistance (High): 1.0740

Support (Low): 1.0620

GBP/USD

Resistance (High): 1.2600

Support (Low): 1.2465

AUD/USD

Resistance (High): 0.7566

Support (Low): 0.7527

USD/CAD

Resistance (High): 1.3169

Support (Low): 1.3076

USD/JPY

Resistance (High): 114.94

Support (Low): 113.44

EUR/JPY

Resistance (High): 123.13

Support (Low): 121.44

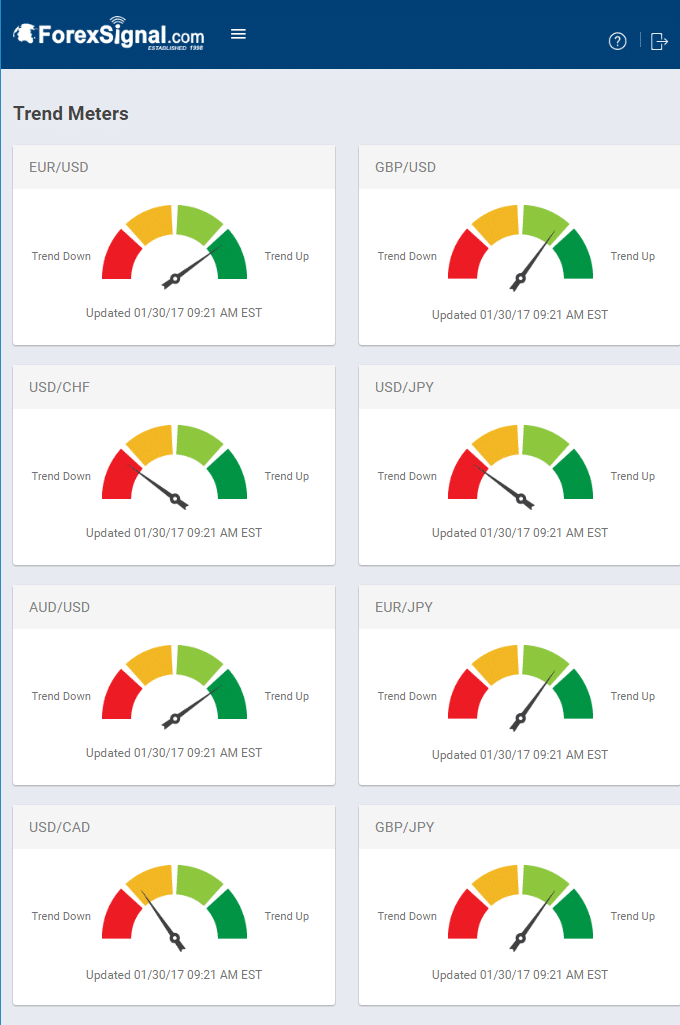

Trend Meters for the Majors and commodity pairs for January 30-31, 2017.

Forex Signal subscribers can view updated Trend Meters by logging to their account online.

USD – Trading With Caution

USD – Trading With Caution

Leave a Reply

You must be logged in to post a comment.