U.S. Dollar

U.S. Dollar

The US dollar dropped again against the majority of its peers on Wednesday on the release of slightly weaker-than-expected U.S. ADP jobs data. Also dovish comments from Federal Reserve officials increased concerns about the next rate hike from the central bank. However, profit taking later emerged and lifted the dollar.

The surge in the greenback enabled some profit-taking on our USDCAD signal to buy at 1.2576 that was sent early Wednesday morning.

NFP

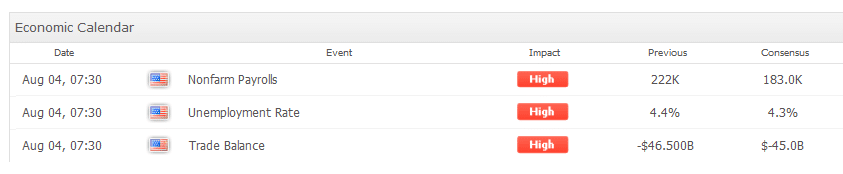

Tomorrow is the much-anticipated monthly Non-Farm payroll jobs report (NFP) at 8:30am EST time in the USA. The US dollar is already showing weakness ahead of tomorrow’s trading.

What to expect if you are trading on NFP Friday tomorrow August 4th.

USDJPY

Going up against the Japanese yen, the greenback traded with a firm bias yesterday and gained to 110.97 before clipping its gains on the back of weaker-than-expected U.S. ADP jobs data and dovish comments from Fed officials. Price fell to 110.27 before staging another rebound, since then the greenback has again reversed and dropped as low as 109.85.

Euro and Sterling Trading

The euro pared its losses and rebounded to 1.1892 in New on dollar’s broad-based weakness with seeming momentum to continue its surge.,

The GBP traded with a firm bias and had a go at its 10-month peak at 1.3245 in European morning before retreating to 1.3111 on profit-taking.

U.S. Dollar

U.S. Dollar

Leave a Reply

You must be logged in to post a comment.