How much further can the US Dollar go?

How much further can the US Dollar go?

In earlier articles I admitted my bias towards a continuing strong Dollar.

That said, I also understand the need to have an open mind to all factors and the possibility that not everything travels in a straight line. As we have always stressed in our training programs, there comes a time when a view needs to change as the contributing factors dictate.

When it comes to Forex and trends, there will always come a time when you have to look in the mirror and say “No more. It’s done. And now it is time for a change of view.”

So I practiced what I preached and looked at everything that could affect my bias toward a strong USD and the facts on the ground.

It started with our equity market sell off in August that made everyone tremble. This was followed by the latest US job reports, which if anything was very disappointing for the US economy. Strangely enough, the effect of these were minimal and the Dollar surge continued.

Ok, time to discuss last weeks game changer. Everyone waited with baited breath for the FED decision that was going to change everything. Pundits from all over the world chimed in their opinions and supporting research. Then, when the FOMC statement arrived, the market responded with a mixed reaction but initially looked to be the FINAL knockout blow that would derail the surge of the US Dollar.

Traders jumped on the news and the European pairs surged like they were on steroids. Even with all of my previous biases to a strong US Dollar, I was more than 50% convinced that the Euro and the other majors were about to make a strong comeback and the last few months of the year would see some very strong Dollar sell off.

As the Trading Chief on the trading desk at ForexSignal, I was at ease with the idea that my strong USD view had finally run it’s course. But something told me, “Not so fast. Let’s give it a day or two to confirm.” Once confirmed, it would be all systems and we would could look to generate trades tor our subscribers worldwide with the bias to now selling the Dollars.

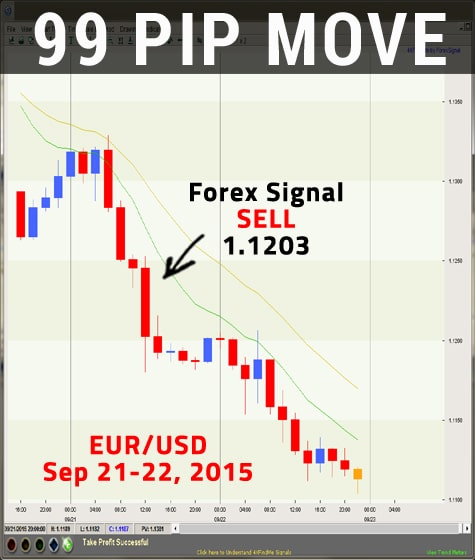

The biggest irony of all, over the weekend I looked at all the charts and the first thought to enter my mind was “Wow look at this pullback – what a great opportunity to SELL the majors into this rally.” I guess hindsight is 20/20 vision. The good news is as the market unfolded and the Dollar began to shrug off the initial move against it we entered a position to short the EURUSD about halfway through the USA session on Monday. We have now closed out our open position and glad to say it is now “ money in the bank.”

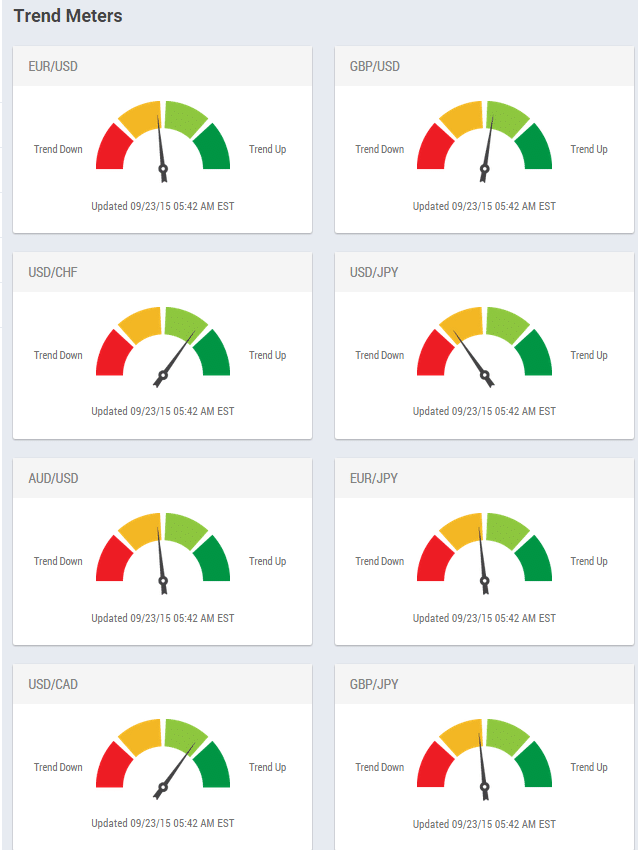

At this stage we see no good reason to initiate any trades other than to go long on the USD. Maybe something will come up and change the trajectory but as of now the Dollar Reign continues in my opinion.

Our Daily Trend Meters (shown below) confirms continuing USD strength with the possibility of a turn around..

How much further can the US Dollar go?

How much further can the US Dollar go?

Leave a Reply

You must be logged in to post a comment.