Forex Review – September Around The Corner

Forex Review – September Around The Corner

Euro

The forex trading week has ended and it is now time to take a look at the updates from the major currencies around the world.

The euro was amongst the losers during the week of August 14th, however, it had been able to successfully turn the tide and become one of the strongest currency last week. The currency’s path to domination began early as it soared higher than the other currencies on Monday. The euro then ended Tuesday on a mixed note before getting bid higher again come Wednesday. This came about after some positive results were recorded for PMI in Germany, France, and the euro zone. The reading improved from 55.7 to 55.8 in August

We sent a Forex signal on Thursday August 24th to buy the EUR/USD at 1.1805. It took some patience, but the trade finally hit all 3 targets on Friday.

Yen

The yen pairs were tracking the bonds throughout last week and this made the currency to be the second worst-performing currency after the Kiwi.

Early in the day on Monday we sent a signal to sell the USD/JPY at 109.09, and it didn’t take long for the trade to fill and hit all 3 of our targets.

Loonie

The loonie, who was the winner the previous week, lost its position and was knocked down to third place last week. The currency had a strong outing even though oil prices were down and couldn’t lift it much.

The price action that came about after the retail sales report meant that the pre-emptive purchase was the main reason why the CAD gained strength. Trump threatened that he will end NAFTA at the time, and that might be the reason why investors were spooked.

USD

The USD couldn’t follow up its August 14th week’s excellent performance as it had a bad run last week. The bad run was due to what Yellen didn’t say. Yellen made no emphasis on inflation and monetary policies and talked about regulations and its positive effect on financial stability instead. This made investors disappointed and this led to the bad run for the greenback.

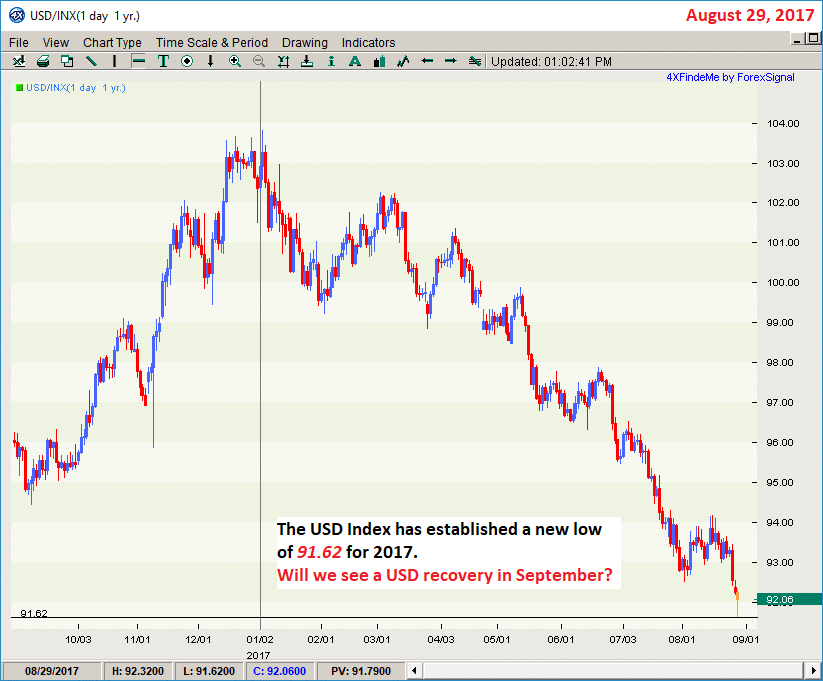

Interestingly, today the USD Index touched 91.62 and established a new low for 2017.

Will the USD rise again come September? Time will tell.

Forex Events: 28th August- 1st September 2017

For this week, here are the major events that are slated to happen.

- CB Consumer Confidence: Tuesday, 14:00. The week will begin with conference board’s consumer confidence. The result was surprising last month as it rose to 121.1 points. It is expected that the confidence level will drop to 120.3 this month.

- ADP Non-Farm Payrolls: Wednesday, 12:15. ADP has been a payroll software provider for a while now and they are set to publish their jobs report for the private sector. The outcome of their reports will always have an influence on the market. In July, a gain of 187k was witnessed while it is expected to be 186K for this month.

- US GDP (second release): Wednesday, 12:30. The world’s largest economy made a comeback in the second quarter with 2.6% according to the first release. The second data for this quarter will be released on Wednesday and it is expected that an upgrade to 2.7% is on the cards.

- Euro-zone CPI: Thursday, 9:00. This data is coming up after ECB President Mario Draghi spoke out in Jackson Hole. The results from July saw inflation stand at around 1.3%, while the core CPI bounced back to 1.2%. This week’s release might see the CPI rise to 1.4% y/y while core CPI remains unaltered.

- Canadian GDP: Thursday, 12:30. The country has so far recorded a very favorable growth in 2017 and this month’s GDP update will give further insight into that. It is expected that the economy will witness a slower growth rate of 0.1% this month.

- US Non-Farm Payrolls: Friday, 12:30. This event will be one of the last events of the week. The fates of the next rates hike is still unknown and it is expected that there will be a gain of 180K jobs while the unemployment rate will be the same (currently standing at 4.3%.) wages, on the other hand, are expected to rise by 0.2% m/m

Leave a Reply

You must be logged in to post a comment.