Yen Weakens

Yen Weakens

The yen weakened against the USD and Euro overnight as the demand for the safe-haven yen lowered in view of the recent rebound in global stocks and the decline in U.S. Treasuries.

Technical Analysis

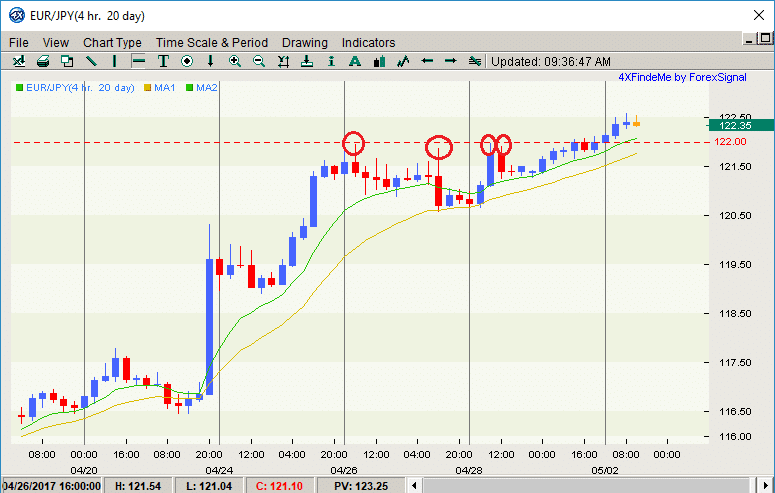

From the technical standpoint, we see that the EURJPY has attempted to break and carry a move above the big figure of 122.00 four times since April 26th but was unable to find enough momentum to push the move until today.

At ForexSignal we anticipated this move yesterday when we sent this signal to our clients worldwide yesterday:

EUR/JPY Buy Order = 122.01 Stop = 121.24 Take Profit #1 = 122.31 Take Profit #2 = 122.41 Take Profit #3 = 122.61

At the time of the writing of this article, the signal successfully reached Target 2.

Will the EUR/JPY have enough momentum to continue long? Keep in mind that the EURJPY has been fighting resistance since December and even with last week’s strong Euro move after the French election and considering the weaker yen, the pair will still need a strong shove to sustain a move above 122.00

We do not expect to see much movement on the yen for the rest of the week as Tokyo markets are closed for public holidays from Wednesday-Friday which should decrease liquidity of the currency.

Dollar Outlook

We wrote an article last year about how dollar bulls LOVE the month of May and that for the past 10 out of 12 years, the Greenback has strengthened. Will the Greenback see seasonal strength again this May?

This first week of May should set the stage for us as we anticipate the FOMC Meeting and Fed minutes on Wednesday and NFP release on Friday.

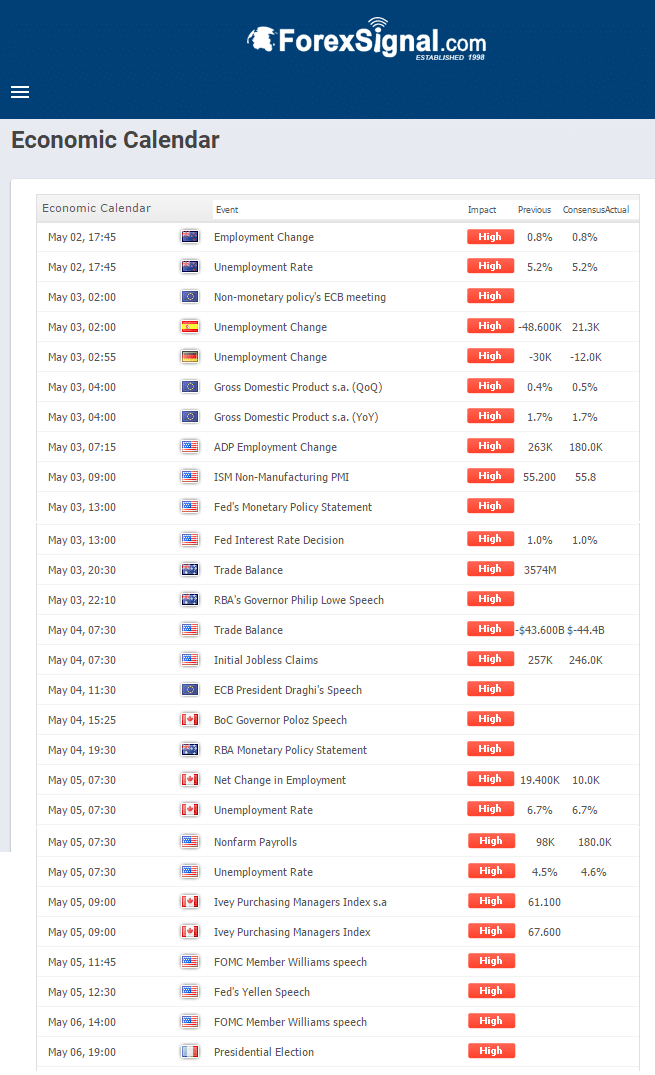

Other Big Events on the Economic Calendar:

With so many upcoming events, we should see the Forex market activity picking up and we will be ready to send Forex signals to Forex traders all over the world as trades confirm to our criteria.

Leave a Reply

You must be logged in to post a comment.